#1 PE/Growth/VC/IB/HF Recruiting, Training & Networking Platform in North America

Democratizing Access to Top Finance Careers & Networks & 100% Built by Professionals

Meet Your Investment Banking Mastery Instructors

Kaushik (Lead)

- Goldman Sachs Investment

Banking - VP & Chief of Staff (IBD FIG) -

Goldman Sachs Private Equity - Principal

- Varde Partners PE - Director

Brandt

-

Centerview Partners - Principal

-

Goldman Sachs

Investment Banking -

Vice President, Associate & Analyst

Vince

-

Goldman Sachs Investment Banking -

Associate

Abhi

-

Evercore Investment Banking

-

PwC M&A Transaction

Dustin

-

Morgan Stanley Investment

Banking - Executive Director &

Recruiting Lead -

Bank of America Merrill Lynch M&A

Kelsey

-

Goldman Sachs Investment Banking

-

JP Morgan Investment Banking

-

Blackstone Private Equity

-

Ares Private Equity - Vice President

Dylan

-

Goldman Sachs Investment Banking

-

Centerbridge Private Equity

-

GTCR Private Equity

CURRICULUM:

8 Hours, 75 Video Lessons, 7 Modules Taught by Pros

Module 1:

Message to Incoming Investment Bankers & Candidates from Successful Professionals

1 hour

-

Top 10 Keys to being a Top Bucket Performer & Building the Perfect Analyst & Associate

-

Top 10 Early Career Mistakes & How to Avoid Them

-

Career Paths & Success: Analyst to Associate to Vice President to Executive Director to MD

-

6 Case Studies Presented By Bankers on Deals they've Worked on:

-

$100bn M&A advisory

-

$40bn M&A sell-side

-

$9bn M&A buy-side

-

$3bn IPO

-

Dual-Track Buy-side & Sell-side M&A; Growth Capital Raise

-

Module 2:

The Most Important Things to Know about the Investment Banking Job & M&A Transactions

2 hours

-

Overview of Investment Banking Functions, Product / Industry Groups & Projects

-

Mergers & Acquisitions: All About M&A Transactions:

M&A Strategy, Tactics, Rationale, Types of Transactions and Pros / Cons -

5 Phases of the M&A Process:

Pitch | Sell-side Preparation | Round 1 |

Round 2 | Exclusivity, Signing and Closing - M&A in Detail: Banker Roles & Responsibilities, Timeline, Sell-side vs. Buy-side

Module 3:

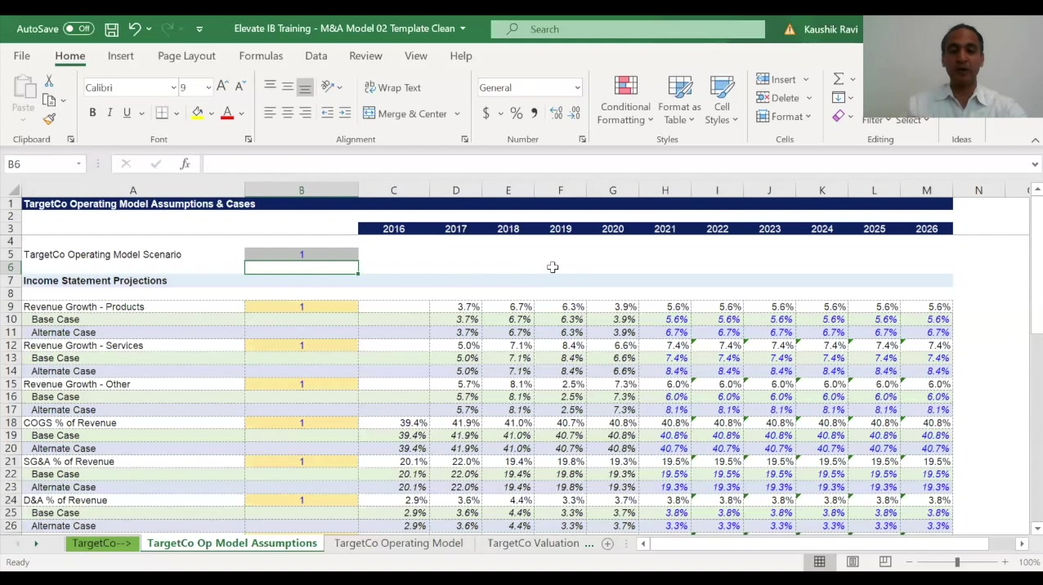

Financial Modeling I - All about Building 3-Statement Operating Models

1 hour

-

Financial Modeling Overview

-

3-Statement Modeling:

Decomposing the Income Statement, Balance Sheet & Cash Flow Statement -

Step-by-step Excel Build of Operating Model from Scratch (Including Scenario Analysis)

-

Projections Modeling: How it's done in the real world

-

Step-by-step Excel Build of 3-Statement Projections Model

Module 4:

Financial Modeling II - All About Investment Banking & M&A Valuation

1 hour

-

Valuation Overview & Perspectives

-

Relative Valuation - Trading & Transaction Comps

-

Discounted Valuation Analysis in Detail: Behind the Scenes with Professionals on Assumptions, Methodology and Best Practices

-

Valuation Methodologies Pros & Cons and How they are used in Banking

-

High-level Overview of Leveraged Buyout (LBO) Analysis

-

Step-by-Step Excel Build of DCF, Trading Comps and Transaction Comps

Module 5:

Financial Modeling III - All About Investment Banking Merger Modeling

1 hour

-

Merger Modeling Rationale, Overview & Banker Perspectives

-

Transaction Assumptions & Purchase Consideration (Stock vs. Debt vs. Cash)

-

Revenue & Cost Synergies & How Bankers Think About Synergies in M&A

-

Sources & Uses in a Transaction

-

Purchase Price Allocation & Closing Balance Sheet

-

M&A Accretion / Dilution Analysis

-

Step-by-Step Excel Build of Merger Model, incl. Scenario & Sensitivity Analyses

Module 6:

Initial Public Offerings (IPOs), Capital Markets & Hostile Takeovers

30 mins

-

Overview of an IPO Transaction:

$3bn IPO Case Study -

Key Deliverables and Banker Responsibilities in an IPO

-

Behind the Scenes of Helping Company become IPO-ready

-

Overview of Timeline and Workstreams in an IPO

-

Investment Banking M&A and Capital Markets Divisions Working Together

-

Mechanics, Pricing, Stabilization & Trading of an IPO

-

All About Hostile M&A Takeovers:

$200+bn Defense of P&G, and $6+bn Defense of Illumina - by Bankers on those Deals

Module 7:

Recruiting Guide for Investment Banking & Finance Careers Beyond

1 hour +

-

Mock Interview with Goldman Sachs Associate

-

What Banks & Firms are looking for; Guiding Principles for Recruiting

-

Networking Effectively

-

Interview: Hear from Professionals on what they are looking for on all the Interview Questions:

Fit: Background | Why Finance / IB | Strengths / Weaknesses | Failures | Many More

Technicals: Accounting | 3-Statement Analysis | Valuation | M&A Modeling | More -

Specific Advice: For Incoming Summer Interns & For Laterals

-

Buy-side / Private Equity Recruiting Process in Detail : Logistics, Timeline and Interviews for Mega Funds & Middle Market Funds

Testimonials from Professionals from Top Firms & Successful Candidates

Mark Cuban on Elevate

Mark Cuban on Elevate

Goldman Sachs Investment Banking

Warburg Pincus PE | Boston Consulting Group

Centerbridge Private Equity | Goldman Investment Banking

Hear from Successful Candidates

(Hundreds of 5-Star Reviews!)

"The Elevate training got me my job at Goldman. Five instructors from Goldman. If you want to succeed at the top firms, learn from people there!"

- Investment Banking Analyst, Goldman Sachs

"I got an offer from Morgan Stanley NYC and have a 5th and final round at Blackstone. I factually could not have gotten this deep in these processes without the Elevate training. Thanks for making it!"

- Investment Banking Analyst, Morgan Stanley

"I would recommend the Investment Banking Mastery Training to everyone entering banking or recruiting for it. The learning and advice from real professionals, along with all the conceptual and technical focus make this the best training out there. Highly recommend!"

- Investment Banking Analyst, Barclays

"After going through the Elevate training, I regret buying the WSO package earlier this year. Content on Elevate is far superior because it's from real pro's, it's not even close to be honest."

- Investment Banking Candidate

"This IBD Training does an incredible job of taking you behind the scenes and really explaining what it takes to become a top-performing incoming investment banker or summer intern, and in detail. It felt like a VP sitting next to me teaching me important concepts at a granular level. As a student leader, I've recommended it to others on campus and it's helped several people already land jobs!"

- Investment Banking Analyst, Credit Suisse

"This training really provides a ton of value for anyone going through the recruiting process or if you're getting ready to start as an investment banker - summer or full-time. In addition to IBD concepts and modeling, goes in-depth into topics like the M&A process, types of transactions, IPOs / Capital Markets - that isn't in any other training out there that comes close. Plus, you get to hear directly from successful professionals on every topic"

- Incoming Investment Banking Summer Analyst, Evercore

"Overall, it's really impressive. As someone actively preparing for the recruiting process, the most helpful part for me was professionals walking through interview questions and sharing what they are looking to hear from the other side."

- Student, Top 10 UG University

"On par or better than even the top MBA-level courses on M&A and Investment Banking. The content is in-depth but also practical. Such access to real-world learning from successful professionals was a game-changer for me"

- Associate, Goldman Sachs & Top 3 MBA

"This course addresses, really effectively, some of the challenges that I've witnessed incoming bankers or candidates struggle with - having a solid grasp of IBD & M&A processes and an understanding of what's required to succeed on the job - both technical and soft skills."

- Managing Director, Investment Banking,

Top 3 Investment Bank

"I previously bought the Elevate Private Equity Mastery and loved it. This Investment Banking Mastery is on par or even better. Extremely high-value content at an economical price! Really helped me get my job. Can't recommend enough!"

- Incoming Investment Banking Summer Analyst, Bulge Bracket Bank

"When I was in school and if I had access to Elevate, I would definitely take advantage of it. Best resource around!"

- Private Equity Associate, Warburg Pincus

"Really transformational. As a student leader, I'll recommend this for anyone recruiting for or entering Investment Banking. The level of information and access to professionals is incredibly differentiated."

- Incoming Investment Banking Analyst, Lazard